Robots, capable of performing both manual and cognitive tasks autonomously, have been integrated in various industries. The increasing adoption of robots has generated concern about the loss of jobs and skills. Our paper addresses these concerns by studying the introduction of robots in US manufacturing plants during the period 2010-2022.

Robots transform the workplace through three main channels: substitution, complementarity, and productivity. Robots substitute for certain tasks, especially routine, precision-intensive, or hazardous ones, thereby reducing the demand for labor. At the same time, their introduction generates new tasks, such as designing robotized workplaces, installing and programming robots, and supervising, maintaining, or “babysitting” them. These tasks create demand for additional engineers, technicians, and operators, or require existing workers to upgrade their skills. This is the channel of complementarity. Finally, robot adoption raises productivity: Adopting plants produce not only more but also higher-quality goods, which boosts sales at the expense of outcompeted non-adopters. Furthermore, robots are commonly introduced only in some stages of the production process in a plant, where increased productivity also increases production and employment in other stages of the production process.

A novel approach: plant-level analysis

Early research on industrial robots relied mainly on industry-level variation in exposure to automation and generally found negative effects on manufacturing employment. More recent research shifts the focus inside firms and shows a more nuanced picture: when firms adopt robots, productivity can increase, tasks are reallocated, and robots often complement human labor. As a result, employment can grow within adopting firms even when overall employment in the industry or economy is falling.

However, most manufacturing firms operate multiple plants, and robot adoption typically occurs in only a subset of them. Firm-level studies therefore combine the effects of adoption in some plants with any spillovers to non-adoption plants within the same firm, potentially offsetting positive and negative effects. Plant-level analysis is crucial to isolate the direct effects of robot adoption where it actually occurs.

In our paper, we identify robot adoption at the establishment level in U.S. manufacturing from the late 1990s to the early 2020s and show that adopting plants increase both employment and production. The increase in production exceeds that in employment, consistent with productivity gains. Employment rises across skill groups in production as well as in support functions.

Robot adoption increases employment in adopting plants across all occupations and skill-levels

The gains in job postings extend across all occupations—production and support roles alike—and span the entire skill spectrum, from low- to high-skilled work. Even occupations directly affected by automation, such as welders, painters, and packagers, experience increases in job postings. For example, the General Electric plant in Norwich, NY, advertised 169 job openings between 2014 and 2022. Of these, five were specifically for robotic welding positions (SOC code 51-4122), beginning in 2017. The first posting sought a welder capable of setting up a welding robot. The trend continued, with 33 additional welder positions posted from 2017 onward. Before adoption, only 20% of non-robotic welding job postings required troubleshooting skills; after adoption, more than half did. This example illustrates both the growth of job postings in directly affected occupations and how robot adoption reshapes skill requirements, driving demand for complementary capabilities and supporting overall productivity growth. Expanding plant production also raises demand for support functions, though the relative increase is smaller than that observed for production workers.

Positive spillovers of robots from adopting to non-adopting plants

Robots enhance competitiveness through productivity and quality enhancement, resulting in greater output that increases demand for employees in the non-robotic parts of a plant and in some upstream and downstream plants that belong to the same firm. In multi-plant firms in which some plants adopt robots but others do not, demand for labor in non-adopting plants rises but much less than in the adopting plants. This is evidence for positive spillover effects at the firm level, with the spillover effect being much smaller than the direct effect at the plant level.

Co-Authors:

- Adrianto, Ministry of Finance, Government of Indonesia

- Avner Ben-Ner, Professor, Carlson School of Management, University of Minnesota

The Power of "Why Not?": My path into Engineering

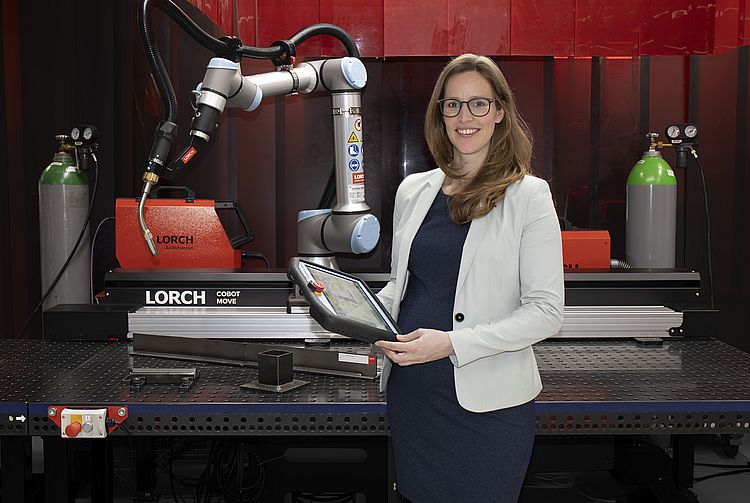

I was genuinely surprised (and once it sank it, deeply honoured) to be named one of the "10 Women Shaping the Future of Robotics 2025" by the International Federation of Robotics.

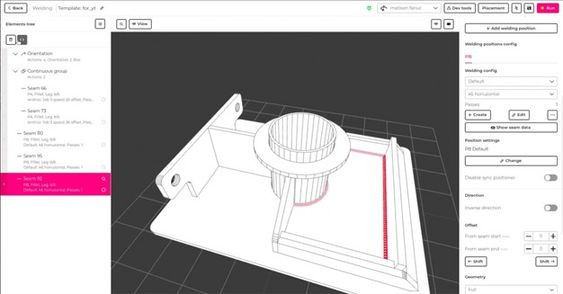

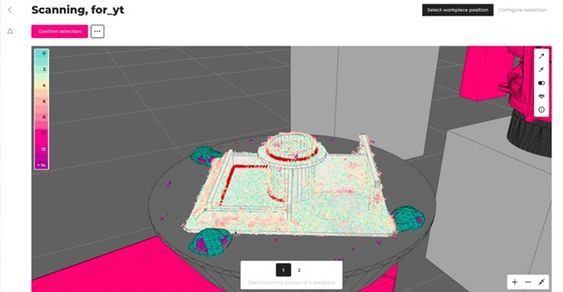

First off, a huge thank you to the whole team at Lorch Schweißtechnik GmbH where I’ve received and continue to receive amazing support to develop our Cobot Welding World for bringing easy-to-use automation to the world of welding.

The journey to robotics and welding (which are traditionally very male-dominated working environments) wasn't always easy or straightforward. In this post, I want to share about the foundation that started me on this journey, the support I encountered and the continuous effort it takes to stop doubting oneself.

My Grandfather’s Basement Workshop

My connection to technical things started early: I was seven years old when my grandfather died. It wasn't until years later that I understood how much he had prepared me for the journey ahead.

When my brother, my three cousins, and I visited our grandparents, we could often be found in my grandfather's carpentry workshop in the basement. We always had a screwdriver, a file, or some glue in our hands, building, screwing, and sawing with him. That basement was the very first environment that encouraged us without question, essentially saying, "Why wouldn’t you be able to do this?".

Today, four of us are in technical jobs, and three of us (all females!) are engineers. I believe that early, hands-on experience and that unconditional support is the most crucial thing for building a technical interest. I was allowed to explore without being questioned or challenged; my path was fully supported. That simple “why not?” attitude stays with me today.

Facing (Self-)Doubt

I did well in school. I took advanced physics, did an internship in textile chemistry, and joined the Student Engineering Academy. People around me had faith in what I could achieve. This was all despite the fact that I was often the only girl in those courses.

The real moment of truth came right before university, during the maths preliminary course. It was tough, and for the first time, I started to seriously doubt myself: "Am I really in the right place? Can I handle this?". The guys next to me were talking about LEGO Mindstorms, coding their own software, and welding their own mopeds at home. I didn't have any of those hobbies, and my self-doubts grew.

Fortunately, soon after, I attended an event just for first-year female students. A senior student there told me something I'll never forget: "You chose this study for many reasons. Look around: Who are the other guys next to you? Many of them just asked their friends what they were going to study after school finished and decided to follow suit without putting as much thought into it as you did.". She reminded me that I had specifically chosen this path after evaluating my personal interests and goals and that I could definitely succeed.

Throughout my following studies and early career, having someone else believe in me was a constant driving force. When interviewing for a student research job, I had to work on motor parameters and virtual simulations. These were topics I did not yet know much about. But a mentor said, "I think this suits you. I believe you can do it.". I took the chance and it worked out. The same pattern applied to my Bachelor's thesis and even my Ph.D. I was approached with a complex topic and told, "I have faith in you.". I tried it and realized, "Oh, I really can do it!".

I received so much encouragement, especially from people outside my immediate circle. Step by step, I learned to not always trust that voice of doubt inside my head. I also actively sought out role models to see living proof that my goals were possible.

This support and belief from outside was crucial to me for finding and following my path. I was usually the only woman in the room and felt a lot of pressure that my behavior would be generalized as "how women are", and often felt I had to follow a strict script.

Today, I am grateful for those who saw my potential and helped me understand that with passion and the right support, women can successfully lead and innovate in complex fields.

My ask to you: Be the support, encouragement, and ally for a woman or girl in your circle

Welding, even more than robotics, is very male-dominated. There just aren't many visible female experts or role models, therefore furthering the concept that "this might not be a career for women".

I am proud to be an example that shows the opposite is true - with lots of passion for what I do, really positive and supporting feedback by my environment and a successful product to show for it.

My vision is simple: when a little girl shows interest in engineering or metalwork, her motivation should not be questioned; it should be celebrated and fully supported. Our industry desperately needs all the talent it can find. Far too often, we question young women on their path and plant the seeds (or even grow!) of self-doubt that make them walk away from technical careers.

My message to you is this:

- For the youngest girls: support their interests, show them what is possible and include them in the conversation.

- Be aware of stereotypes and support initial interests – no matter whether them being “typical male” or “typical female”

- We, as managers, colleagues, parents, relatives, teachers, and mentors, are the ones who can ensure girls have a choice about their career path that is truly free of bias.

Please carry this thought into your conversations with every girl you know. I am absolutely certain that more female talent will benefit all of us, whether in engineering, robotics, or welding.

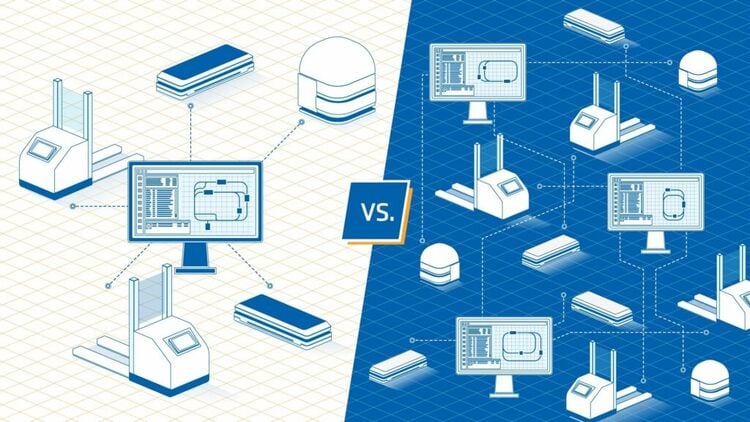

Service robotics is an industry on the move. In the past, the market primarily focused on specialized robot systems that performed a single task really well at a low cost. Today, massive investments in multipurpose robots, mostly in the form of humanoid robots and with enhanced AI capabilities, can be observed. Whether these robots will become a game changer remains to be seen, but so far sales have been very limited. Nevertheless, they will form a technological foundation, and other robots will benefit from the rapid advancements in AI, perception, and manipulation, which are also being developed for humanoids. Further, initial practical trials are already underway.

Autonomous mobile robots have been a growth market for many years, with more than 300 manufacturers worldwide. Further interesting markets are delivery robots in restaurants, field robots, mobile assistants in lab automation, and search and rescue or inspection robots. However, some of these systems are yet to reach scale, and some consolidation effects can already be observed.

Many details about the market and technologies are described in this book. The 2025 edition of “World Robotics Service Robots” presents figures and market data from the previous year. As was the case in previous years, large growth markets contrast small, highly specialized niche markets, with many start-up joining the fray, while other companies struggle to gain a foothold in the market.

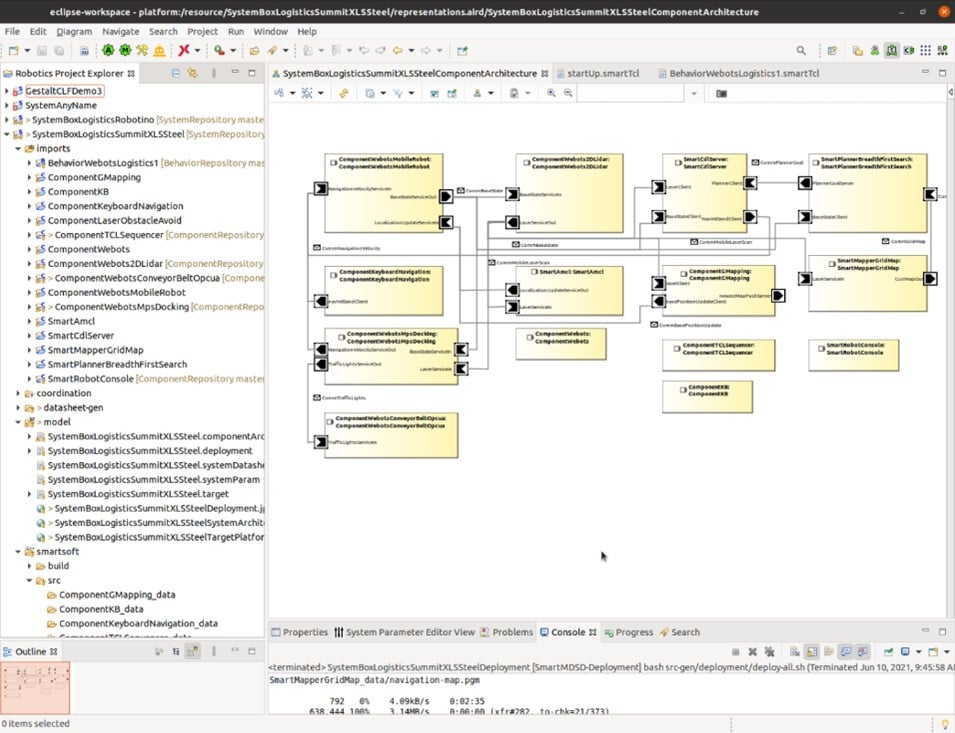

We have once again included six interviews with robot manufacturers from around the world. This year, we focused on the applications AP 51 “Logistics robots for indoor environments without public traffic” and AP 64 “Laboratory robots”. The interviews give valuable insights into company strategies, market opportunities, and hurdles that need to be overcome to widen the usage of service robots in the mentioned applications.

Some findings from the interviews were the following:

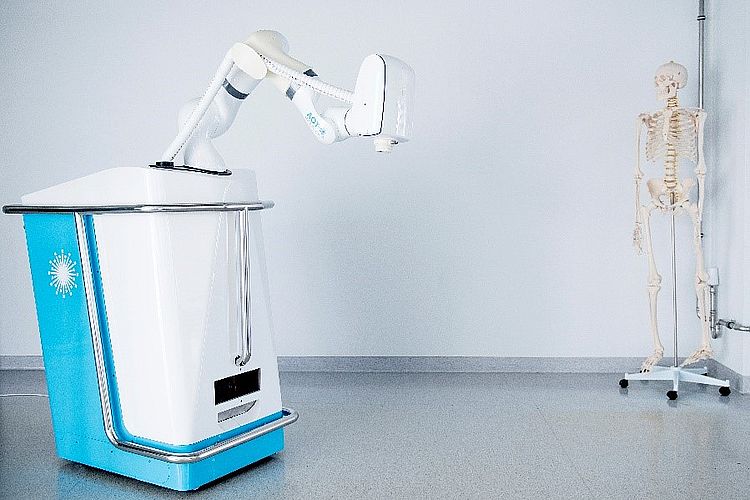

Laboratory robots

- Need for automation: The development of robots for lab automation is driven by the urgent need for efficient solutions to support medical personnel and the increasing demand for automated procedures. This is particularly relevant during times of workforce shortages and heightened workloads.

- Importance of collaboration and expertise: Integrating knowledge from various fields is crucial for the successful development of automation solutions in new domains. Interdisciplinary collaborations can lead to innovative approaches for automating complex processes, thereby enhancing the efficiency and accuracy of outcomes.

- Shift in business model: The transition to a service-oriented business model, focused on the results of automated processes, indicates a new strategic direction. This shift delivers added value to customers, while enhancing the flexibility and adaptability of automation solutions.

Mobile intralogistics robots

- Strategic focus on automation growth: The development of robots for intralogistics has been driven by the increasing demand for low-cost automation solutions, leading to significant production growth and highlighting the rapid expansion of the mobile robotics market.

- Integration and customer-centric development: Successful integration of robotic solutions requires a comprehensive understanding of customer needs, effective project planning, and a focus on co-creation methodologies. Addressing installation challenges, while ensuring high functionality and reliability, is essential for market acceptance.

- Adapting to evolving market challenges: As customers face labor shortages, the need for digital transformation, and shorter planning cycles, there is a strong emphasis on enhancing interoperability among automation systems. Companies must prioritize usability and build collaborative networks to support the transition to advanced automated environments.

In close cooperation, Fraunhofer IPA and IFR are monitoring 944 companies worldwide that offer service robotics solutions (roughly 7% of them are start-up). Both the professional and the consumer service robotics domain benefit from technical innovations like digitization, cloud technologies, 5G/6G, and artificial intelligence, specifically in the field of machine learning, which lead to technological advancements in service robotics. For the mentioned AI technology, there is an array of generative AI tools available on the market. Generative pre-trained transformers using large language models, e.g. ChatGPT, will turn service robotics inside out, for example in terms of intuitive operation or support for creating program code. Recently, vision-language action models like “π0” have also been gaining attention: they offer large training data sets that can also be expanded through learning effects of robots from teleoperated processes, if needed. It is evident that generative AI has become an integral part of everyday working life – especially for software development, as software code is highly formalized and widely available on the web serving as training data.

“World Robotics Service Robots” has established itself as the widely acknowledged reference publication in statistics, forecasts, market analysis, and profitability of robot investments. Robot suppliers, media, government bodies, financial analysts, and technology scouts are among its readers. It specifically provides profiles of numerous service robot manufacturers worldwide. The many hyperlinks pointing to online resources encourage readers to further investigate topics of interest by looking into selected publications and company websites. We are indebted to our (current and former) colleagues for their valuable editorial work on the yearbook: Winfried Baum, Simon Baumgarten, Nikhil Srinath Betgov, Dr. Florenz Graf, Dr. Theo Jacobs, Florian Jordan, Max Kirchhoff, Dominik Moss, Cagatay Odabasi, Tobias Rainer Schaefle, Ph.D., and Miriam Schmelzer. Furthermore, we highly appreciate the support of Dr. Anne Jurkat from IFR and Dr. Karin Roehricht from Fraunhofer IPA in preparing the report. Should you have any suggestions or further inquiries related to service robotics, please do not hesitate to contact us!

Best regards,

Dr. Werner Kraus, Dr. Birgit Graf, Kevin Bregler

Service robots are quietly reshaping our daily environments. Once limited to factories or research labs, today’s robots are becoming part of hospitals, classrooms, and public spaces, working alongside people and supporting tasks that range from industry to research. This shift marks a turning point in robotics: it is no longer a question if robots will be present in our lives, but how they will contribute meaningfully.

The growing demand for robotics in sectors such as healthcare and education has driven the development of more versatile, mobile, and user-adaptable systems. Mobile manipulators, in particular, are evolving from task-specific tools into general-purpose platforms. At the same time, a new emphasis on modularity allows these platforms to be configured and customised for a range of use cases, offering solutions that respond to real-world needs and changing environments.

Embodied AI: Training for solutions

A key factor enabling this new generation of service robots is the integration of embodied artificial intelligence. Unlike traditional models trained in simulation or on static data, embodied AI learns through direct physical interaction by being present in the environment, and adapting in real time. This approach allows robots to develop behaviours that are shaped by context and experience. Navigating a hospital corridor, adapting to human gestures in a classroom, or responding to changes in layout or routine all require the kind of situated learning that embodied AI enables. These advancements are the result of progress not just in AI, but also in autonomy, perception, and real-time decision-making.

Human-centered design

At the core of service robotics lies a simple principle: technology should serve people. Human-centered design ensures that robots are not only capable, but also intuitive, trustworthy, and safe to work with.

This means designing user-friendly interfaces that reduce training time, integrating collaborative safety features for shared spaces, and developing systems that can adapt their behaviour based on who they are working with. The focus is not on automation for its own sake, but on meaningful assistance, complementing human tasks and easing operational burdens in fields where time and resources are often stretched.

Where robots are making a difference

The real impact of service robotics is clearest where technology meets everyday needs. In healthcare, autonomous mobile platforms are already improving efficiency and resilience by helping hospitals improve internal logistics, transporting materials efficiently and enabling clinical staff to focus on patient care.

In education, robots are enriching the way students learn and engage with technology. They are being used to teach core STEM concepts through hands-on programming and experimentation, and to make abstract ideas more accessible. Especially in remote or hybrid settings, robots can provide new modes of interaction, bringing real-world robotics into classrooms that may not otherwise have access. These tools are not just educational aids, they are also sparking interest in robotics and engineering careers among younger generations.

Beyond these people-centered sectors, service robots are also gaining traction in industrial environments. In warehouses and production facilities, mobile manipulators are being introduced to support tasks such as material handling, quality inspection, and flexible assembly. In contrast with traditional automation, these systems offer adaptability in changing layouts or mixed workflows, complementing human workers in dynamic settings. The ability to quickly reconfigure or relocate robots makes them especially valuable in sectors where agility and customization are key.

Towards truly helpful robots

For service robots to thrive, they must go beyond performing tasks, they must understand the spaces they operate in, adapt to the people they assist, and be designed with a clear purpose: to help. This means more than technical capability. It means creating systems that fit into human routines, environments, and expectations, and that can respond flexibly when those change. The future of robotics will not be defined entirely by innovation, but by integration, by how well robots work with us, in ways that are meaningful, supportive, and aligned with real needs. In that future, robots are not just tools. They are partners in creating environments that are safer, smarter, and more human.

Image credit: PAL Robotics

Automation is a cornerstone of modern manufacturing - and it's entering a new era. While robotics continue to stabilize and scale production, AI-powered and software-driven solutions are unlocking new levels of adaptability and reach in previously unautomated areas. This shift is making automation more accessible, especially for small and medium-sized enterprises, and helping industries counteract labor shortages, boost flexibility, and future-proof operations.

In an increasingly fast-paced and volatile world, the need for robot-based automation goes beyond efficiency. It’s about resilience. Robots enable stable, scalable, and predictable production, helping companies adapt to short-term fluctuations in demand and support decentralized manufacturing.

In 2024, the global economy remained weak. Although inflation, energy costs, and financial constraints eased, investment activity, especially in Europe, stayed subdued. Rising geopolitical instability and shifting global alliances have led to unprecedented trade policy uncertainty. While overall momentum is lacking and the outlook remains cautious, early signs of recovery are emerging, particularly in China and the robotics sector, offering cautious optimism for automation-driven industries.

Despite economic headwinds, the robotics industry showed resilience in 2024, as reflected in the following key figures:

- Annual robot installation moved sideways to 542,076 units, which is +0.1% compared to 2023.

- Operational stock increased to 4,663,773 robots (+8.9%) and the largest countries in terms of operational stock are China (43.5%), Japan (9.7%), United States (8.4%), Republic of Korea (8.4%) and Germany (6.0%).

- Global robot density (number of industrial robots per 10,000 persons employed in the manufacturing industry) increased from 163 to 177. Countries with highest robot density are Korea (1,220), Singapore (818), China (567), Germany (449) and Japan (446).

- Demand for automotive decreased to 126,088 (-6.9%) installations, whereas demand in electronics picked up leading to 128,899 (+2.5%) new installations making it the largest robotics sector in 2024 again.

- The strongest growing markets were China (+6.8%), Hungary (+156.3%), Chinese Taipei (+32.5%), India (+7.2%) and Vietnam (+27.0%).

- The markets with largest decreases in units were United States (-9.1%), Japan (-3.6%), Italy (-15.6%), Slovakia (-70.7%) and France (-23.8%)

After a challenging year in 2023, Chinas robotics market has emerged from its weak phase and is showing robust growth again in 2024. It remains to be seen whether this recovery will have a positive knock-on effect on other regions, but current indicators suggest that North America and Europe will need to overcome recessionary pressures independently.

Despite short-term economic challenges, the long-term outlook for the automation industry remains positive. At some point, the global economy will recover, and structural factors like labor shortages, reaching new all-time highs in advanced economies, will continue to drive demand for automation. Periods of inflation only reinforce the need for greater efficiency and cost control. These pressures, combined with technological progress, make robot-based automation an increasingly essential strategy for resilient and future-ready production.

These trends reinforce one another and highlight the multidisciplinary nature of robotics. While established technologies are reaching maturity, emerging innovations continue to inspire and expand the possibilities of automation. As more tasks and processes become automated, the market is attracting a growing number of companies. Considering these developments, we remain optimistic about sustained growth in the automation sector - even if short-term forecasts are more cautious than in previous years. Automation will continue to shape the future of manufacturing, driving both innovation and resilience across industries.

The past year presented formidable challenges for companies across the globe. Amid persistent geopolitical tensions, renewed tariff disputes, and macroeconomic volatility, business confidence waned, and investment decisions became more cautious. At the same time, supply chain disruptions once again came to the forefront. For companies, the ability to adapt quickly to short-term changes in demand has become not just a competitive advantage, but a necessity for survival.

In parallel, megatrends that have long shaped the industrial landscape, such as demographic shifts, skilled labour shortages, and increasing sustainability pressures, continued to intensify. These structural issues have compelled companies to rethink their business models and re-evaluate their operational priorities. As a result, automation is no longer viewed solely as a cost-cutting measure or efficiency enhancer; it is now a strategic lever for long-term resilience and innovation.

One key development in this context is the growing demand for automation solutions that are not only effective but also user-friendly and immediately applicable. Companies are no longer content with abstract, high-concept automation strategies. Instead, they seek tangible, turnkey solutions that can be deployed quickly and easily, especially by teams without extensive technical backgrounds.

Importantly, this is enabling a broader set of players to participate, especially small and medium-sized enterprises (SMEs). Collaborative robots, or cobots, in particular are supporting this democratisation of automation. Designed to work safely alongside humans, cobots offer a more accessible entry point into robotics. Their flexibility, ease of use, and compact footprint make them particularly attractive for SMEs seeking to improve productivity without overhauling their entire production infrastructure.

For many of these companies, their first experiences with cobots are proving transformational. They not only achieve immediate gains in efficiency and quality but also accelerate their internal learning curve. Over time, this growing familiarity with robotics opens up new automation opportunities across their operations, unlocking higher competitiveness, better resource utilisation, and an improved total cost of ownership. In essence, cobots are serving as a gateway to a broader and more sustainable automation journey.

This shift is also expanding the scope of industries embracing robotics. Once confined mainly to the automotive, electronics, and heavy engineering sectors, robots are now making significant inroads into areas such as retail, pharmaceuticals, and the food industry. These are domains characterized by high variability, individualized customer demands, and expectations for 24/7 service, conditions where flexible automation thrives.

In practical terms, cobots can take over repetitive or time-sensitive tasks, working alongside humans during the day and independently during night or weekend shifts. For example, in bakeries, hospital kitchens, or convenience food outlets, robots can prepare fresh rolls, sandwiches, or meal kits around the clock. These use cases which have already been showcased by FANUC at major trade shows have captured considerable attention from both media and industry.

Adding to this momentum is the rapid advancement of artificial intelligence (AI). AI-driven tools are further improving ease of use, ease of integration and ease of automation. Here the automation domain sees a rapid development curve for facilitating complex automation solutions, automation of robot programming or new skills deployed on robotic systems. Alongside digital twins, AI is poised to be a major accelerator of robotics adoption across diverse sectors.

However, cobots and AI alone are not enough to meet the multifaceted challenges faced by today’s industries. A third and equally important trend is gaining traction: the move toward stronger partnerships and open ecosystems. In the past, major robotics companies often focused on closed, proprietary systems which locked customers into single-vendor solutions. While this approach offered consistency, it limited flexibility and interoperability.

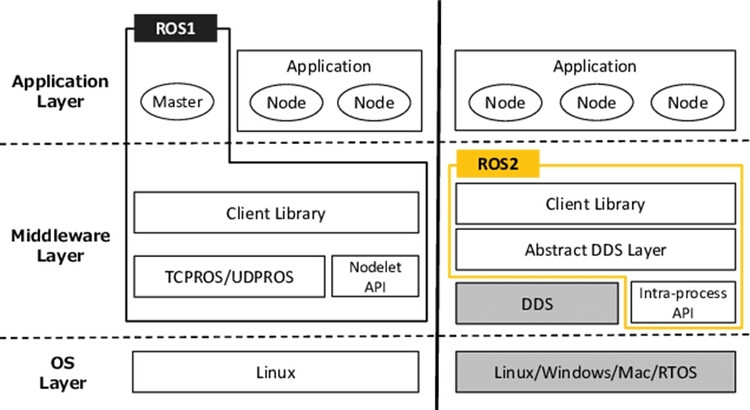

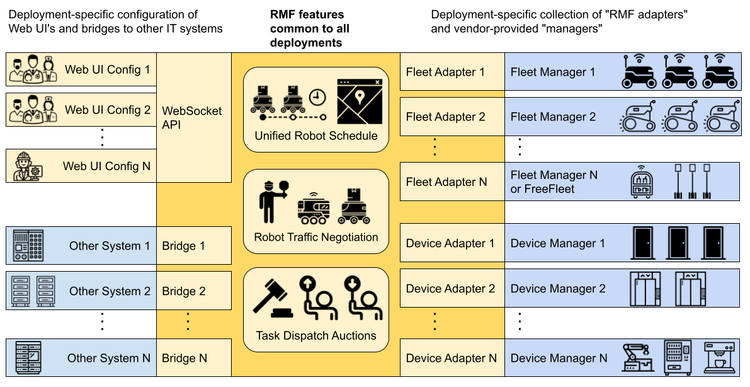

Today, the landscape is changing. There is a growing recognition that no single company can solve the complex automation challenges of modern industry alone. Collaboration is becoming a core strategy. Robotics vendors are now designing products with open interfaces and industry standards. For instance, FANUC’s upcoming robot controller R- 50iA will support platforms like ROS2 and the Smart Robotics Communication Interface (SRCI), and Python script execution, enabling easier integration and giving users the freedom to work within their preferred environments.

This openness is creating fertile ground for new alliances—between hardware manufacturers, software developers, system integrators, startups, and end-users. These partnerships extend beyond technical compatibility; they bring together complementary expertise, domain knowledge, and market access. The result is more holistic, effective, and scalable automation solutions tailored to real-world needs.

In conclusion, 2024 has marked a pivotal turning point in industrial automation. As companies navigate an increasingly complex landscape, the combination of collaborative robotics, AI innovation, and cross-sector partnerships is paving the way for more accessible, adaptable, and impactful automation. The future of robotics lies not just in technological breakthroughs, but in the strength of the ecosystems we build together.

This collaborative expertise is crucial for overcoming skills shortages. Even with cobots, training workers is essential to maximize automation investment returns. Many robot manufacturers support this by offering training programs and partnering with educational institutions to nurture the next generation of robotics enthusiasts. Over time, these efforts contribute to a robust robot ecosystem where suppliers, integrators, startups, and educational institutions collaboratively develop the automation solutions of tomorrow.

Image credit: FANUC

It is an honor to be nominated as one of IFR’s “10 Women Shaping the Future of Robotics” alongside this amazing group of women. Each of us brings unique talents to the table. Encouraging diversity within the robotics sector is important. While there are many efforts to shine a light to attract talent to the engineering and technical side of our business, I’m honored to see marketing recognized in this category. The fact is our industry offers incredible opportunities, not only in technical fields but in business and operational roles. When we attract diversity, and welcome different viewpoints, we unlock potential beyond imagination.

For nearly 30 years at FANUC, I have dedicated myself to amplifying our automation solutions through innovative marketing strategies. My goal has always been to educate, inspire, and connect our customers to the transformative and exciting opportunities that come from automation.

If you asked me to share my thoughts on what has shaped my journey as a leader and helped me make an impact, here's what I would say.

Be yourself

Very early in my career, one of the best pieces of advice I received was to embrace my individuality—to use my marketing perspective as a powerful differentiator to set me apart. Being different isn’t a limitation; it’s a strength that can empower and inspire.

When I first entered the robotics industry, I was often the only woman in the room, on the speaking agenda or at the table. In the office, I was a marketing mind in a world of engineers. While I was always able to grasp robotic concepts and articulate key technical advantages, I did not think like an engineer. That’s the beauty of diversity. I found the courage to speak up, pose questions that revealed a different point of view, strategically open minds to position ideas and get support for initiatives I wanted to move forward.

The truth is when we embrace different perspectives, magic happens. Our discussions are richer, our solutions more robust, and our impact farther reaching.

Foster curiosity

I enjoyed talking to our customers and integrators about what our products were doing for their employees, their production rates, their business and ultimately their bottom line. I was curious and asked a lot of questions. That curiosity drew me into many high-level business discussions, helped me build relationships and network. It was pure curiosity, not networking for my own career advantages, but that’s what it led to.

Curiosity opens doors, conversations and allows ideas to grow.

Strategic Vision

I had the privilege of being part of FANUC's journey from the very beginning as we embarked on formalizing our authorized system integrator program. In laying the groundwork and establishing the foundational elements of the program, I recognized the marketing opportunities that could be unlocked.

At that time, robotics was growing in what we refer to as general industry, which basically was everything except automotive. The general industry world was new – automation was being applied in ways it had never been done before. It was exciting to see not only what we were doing with our technology but the impact on what was being accomplished in businesses small and large everywhere. The diversity and reach – from milking cows to pharmaceuticals – development and innovation thrived. Every system was doing good - making jobs more fulfilling and safer, and making companies more productive and profitable. Manufacturing was staying local and solving problems that had yet to be solved. These stories not only interested me, but they inspired me.

FANUC and our integrators were innovating and forging new paths, yet the marketing side of the industry was technical, quiet, and bland. I wanted to change that.

I developed a strategy and marketing initiatives to leverage integrator solutions. This created a content stream for our marketing efforts that I’m proud to say is still thriving today.

Ambition vs. Passion and Energy

As I grew in my career, I thought a lot about the roles of ambition versus passion. Ambition is defined as a strong desire or determination to achieve something, typically requiring hard work and dedication. It’s often referred to as the driving force behind one's goals or aspirations, whether personal or professional. Passion for work means you feel excited about what you do. You find meaning and purpose in your work. Oprah Winfrey famously summed it up: “Passion is energy. Feel the power that comes from focusing on what excites you.”

I was privileged to have remarkable leadership and mentors, yet no one ever pushed me or set my agenda. I did it on my own…with energy and passion. Good ideas were never in short supply – they always came. Passion gets the job done – when it’s smooth or challenging. Passion supports, encourages and empowers others. Every campaign, every customer experience, every strategy, every endeavor starts with energy and passion to do right by your organization.

In my experience, personal rewards always follow when you lead with passion and energy.

Balance

As women, we are often faced with the challenge of balancing our careers and our families. There are many discussions questioning whether achieving an ideal balance is possible, particularly in the United States. Let’s be honest: society typically places this challenge squarely on women. Can you really have it all? Well, it certainly depends on one’s own definition. For me, having a satisfying and fulfilling career was important, and so was prioritizing my family.

Workplaces that are supportive of women and their aspirations have the best chance of retaining their talents.

I was fortunate to be able to strike a balance as the best employee and mother I could be. I have no regrets about that decision, and ultimately, it didn’t prevent me from growing and prospering in my career. While that was the right decision for me, each of us must define our own path. My message is that it is possible to create your unique version of “having it all”.

Take a Breath

Today, as busy professionals, our schedules are often packed to the brim, leaving little room to pause and reflect. However, creativity requires more than just effort—it thrives in mental clarity and free space. Whether you're crafting a strategy, writing software code, conceptualizing an engineering solution, or devising a compelling campaign, your best ideas won’t surface if your brain is overwhelmed. When your mind is at full capacity, it’s like trying to pour water into an already full cup—it spills over and achieves nothing.

I’ve found that some projects benefit immensely from stepping back and allowing the mind to wander. It’s in those moments of intentional detachment—that inspiration often strikes.

The key is recognizing when to pause. Taking a breath is not a sign of neglect or inefficiency, it’s an investment in the quality of your work. By giving yourself time to think without pressure, you’ll find that your creativity flourishes.

Care

There are so many amazing people tied to this industry. I’ve given a lot to this industry, but I’ve received so much.

Working in a great environment with wonderful people perpetuates care.

Care to show up and be the best you can. Care for your colleagues, your employees, your leadership team, your brand, your customers, and for our industry.

In summary

I really love this industry. I learn something new every day. There’s always a challenge, target or goal that we are all pulling together to achieve. I’ve been fortunate to have had incredible mentors in my years. I have an amazing marketing team, the support of our leadership and frankly I just have a lot of fun doing what I enjoy. I’m humbled and honored to be nominated beside this amazing list of women. Our collective talents are a beautiful blend of skills that fuels industry growth, attracts talent and impacts overall success.

Let’s amplify our voices as women, support each other’s aspirations and create a space where everyone thrives.

Find out more about IFR's initiative "Women in Robotics".

The Innovator’s Journey: From Corporate Innovation to Robotics Entrepreneurship

My professional journey has been guided by one enduring force: an unwavering passion for innovation that drives meaningful change. From the early days of navigating corporate innovation to the entrepreneurial leap into robotics, my career has always centered around identifying untapped potential and building solutions that challenge the status quo. Whether within the structure of a multinational company or the high-stakes environment of a startup, I’ve remained committed to creating technologies that matter.

From Corporate Innovation to Entrepreneurial Drive

My formative years at Michelin Group—a company renowned for its emphasis on R&D and innovation—shaped the way I think about technology and market disruption. As an Innovation Initiative Leader, I was exposed to a spectrum of emerging technologies, from smart materials to connected mobility solutions. More importantly, I learned that genuine innovation is not about chasing trends—it’s about having the courage to ask, “Why not?” and the discipline to translate that question into scalable, real-world applications.

I also felt a growing urge to move faster, test bolder ideas, and take on more ownership of the innovation process. That hunger eventually culminated in co-founding YOUIBOT Robotics—a venture born out of the belief that robotics can redefine the future of industrial automation, not just for global giants, but for small and mid-sized manufacturers around the world.

Pioneering Moments that Defined our Path

One of the earliest and most defining moments for YOUIBOT came during the COVID-19 crisis. At a time when the world was grappling with uncertainty, we rapidly designed and deployed the first EU/US-compliant autonomous disinfection robots, ensuring strict adherence to international safety and certification standards. These robots were quickly adopted across more than 20 countries, operating in hospitals, airports, and public facilities where human presence was risky. The sense of urgency pushed our team to innovate at a pace and scale we had never experienced before. That chapter not only demonstrated our technical agility but also reinforced my belief in robotics as a force for social good.

Another milestone was our expansion into the Japanese market in 2024, a move that challenged us on multiple levels. Japan, with its deep-rooted manufacturing culture and high standards for automation, posed both cultural and technical hurdles. We had to adapt our AMR (Autonomous Mobile Robot) solutions to the unique layouts of Japanese factories, local safety regulations, and operational preferences. Through persistent localization efforts—ranging from software interface redesign to in-person training with our partners—we achieved over 50% annual growth, establishing YOUIBOT as a trusted name in an industry known for its high entry barriers.

What Keeps me Inspired

The driving force behind my work remains the democratization of industrial automation. Robotics shouldn’t be a luxury reserved for Fortune 500 companies. I’m inspired by the potential to help small and medium-sized factories transition from manual to smart logistics, often for the first time. Watching factory workers interact with our AMRs—initially with hesitation, and eventually with confidence—reminds me that innovation succeeds only when it empowers users.

I’m also passionate about mentorship and team building. Nothing excites me more than seeing young engineers blossom into confident problem-solvers. My leadership philosophy emphasizes bridging gaps—between cutting-edge technology and everyday users, between theoretical knowledge and field experience, and especially, between women and opportunities in STEM.

Advocating for Women in STEM

As one of the few female founders in the industrial robotics space, I see it as both a responsibility and a privilege to advocate for diversity in tech. I regularly use platforms like LinkedIn, university guest lectures, and industry panels to spotlight the essential contributions of women in AI, robotics, and engineering. Representation matters, and I strive to make visible the many paths into tech leadership.

To support this mission, YOUIBOT has collaborated with global incubators such as SOSV, launching internship programs designed to attract and nurture young talent from diverse backgrounds. Our goal is not just to train future engineers, but to build a more inclusive innovation ecosystem where ideas are enriched by a multitude of perspectives.

Conclusion

From leading corporate innovation initiatives to building robots that operate across continents, my career has been—and continues to be—an evolving journey shaped by curiosity, resilience, and purpose. The path of an innovator is rarely linear, but with each challenge, there’s an opportunity to build something better—for industries, for communities, and for the world.

Find out more about IFR's initiative "Women in Robotics".

From Farm Life to Factory Floors

I grew up on a working farm with three older brothers, a Mohawk Iroquois mother who taught me fierceness and self-belief, and a father who managed a paper plant by day and was a part-time farmer. Our house was filled with elbow grease, high expectations, and mutual respect. I was expected to pull my weight, fix what was broken, and believe I was just as capable as anyone else.

I didn't grow up dreaming about robots. I dreamed of stability, of opportunity - and of earning my place in the world. After high school, I paid my own way through community college while working full-time in manufacturing. Every decision I made was guided by grit, curiosity, and a desire to make things better.

The Spark That Lit the Fuse

My path to automation sales began when I saw my first SCHUNK product at an SME event in Chicago. I was instantly drawn to the brilliance of technology that could bring safety and efficiency to even the toughest environments. I knew I had to be part of it.

In the early 2000s, a family friend offered a sales role - intended for my husband. He declined, but recommended me instead. That moment changed everything, and I've been working in robotics automation ever since.

People Power Progress

Technology doesn't drive itself - people do. A robot and its code sitting in a warehouse is just expensive hardware until a team of people brings it to life. The same is true of leadership. True innovation happens when we build diverse, collaborative teams where every voice matters.

As a woman in automation, I'm passionate about breaking down traditional gender roles and creating environments where young women can see themselves as leaders, builders, and changemakers.

Paving the Way Forward

At SCHUNK, I lead a sales team that solves complex challenges alongside integrators and manufacturers across the country. I'm grateful to be part of a company that supports women's voices and encourages leadership that reflects resilience, inclusion, and action.

Let's build an industry where talent, drive, and creativity - not gender - define success. Because the future of automation isn't just about smarter machines. It's about stronger, more connected teams of people driving them forward-together.

Find out more about IFR's initiative "Women in Robotics".

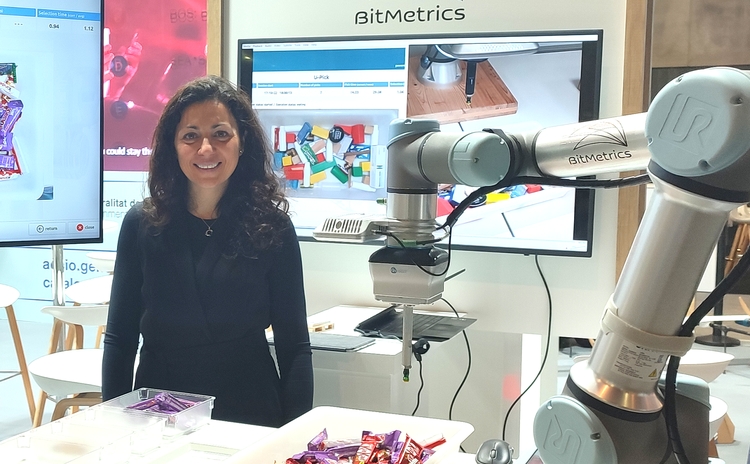

I'm the Co-Founder and Chief Operating Officer at Inbolt.

At Inbolt, we're making robots smarter and more flexible thanks to a real-time tracking technology based on 3D Vision and AI. We have deployed our solution across more than 150 robots right now in 50+ factories on three different continents, the United States, Europe and then Asia.

I got into robotics a few years ago. Actually, we started the company five years ago with two associates right after university. The idea for the company started out on a technology that is using 3D Vision and AI for real-time part position localization that we decided to adapt to robotics to guide robots in real-time and server control them because we identified a big need for more flexibility and more autonomous robots in the manufacturing industry.

Right now, manufacturers have no choice but to automate and this is why the field is evolving super fast. AI, of course, had a big role to play in that and right now customers want to have AI in their factories.

At Inbolt, we've managed to stay ahead of the curve and deliver real value to our customers by going on site and installing our solutions as much as possible, to listen to our customers and be able to deliver value right now while also anticipating what they will need later. Our solution enables robots to be smarter and have more flexibility on the assembly lines.

The challenges that the customers are facing is the lack of flexibility that robots have, which leads to high cost of automation and a low payback or a payback in very long time. By putting vision systems on robots and making them smarter, we enable customers to automate with a return on investment as short as possible.

There is definitely a lack of diversity right now in the field and if I would advise young women in STEM or young women to look for a career in robotics is just to ask questions and really get to understand the end customer. That will drive your whole understanding of the industry and also the solutions that you need to bring them.

Being selected as one of the women in robotics for 2025 definitely means a great spotlight and has been a great proof of achievement from what I've done with Inbolt. Currently building a company of 40 people across three continents, US, Europe and Japan to make robots smarter in the manufacturing industry.

Find out more about IFR's initiative "Women in Robotics".

IFR statistics show that Germany has consistently been a global top 5 robotics market for many years. They also provide distribution by industry. But what it does not show is who exactly is installing these robots and what distinguishes a robot user from a non-user. Data collected from nearly 16,000 plants by the Institute for Employment Research (IAB) of the Federal Employment Agency helps us to learn more about robot users in Germany.

New Insights from Microdata on Robot Use

We use the 2019 wave of the IAB Establishment Panel Survey that asked for robot use between 2014 and 2018. The first and probably most unexpected finding is that robot use was relatively uncommon, even within manufacturing: Just about 8% of the plants used robots in 2018. Secondly, only a small number of plants accounted for most of the robot stock. This means that automation is highly concentrated in a rather small number of factories. Nonetheless, there are clear indications of ongoing diffusion, as new adopters primarily drive recent growth in robot installations. Establishments utilizing robots tend to be larger, more investment- and export-oriented, and more likely to implement other advanced technologies.

What Drives Robot Adoption?

Firm size

Larger plants are significantly more likely to adopt robots. This might simply reflect their greater financial resources and organizational capacity to invest in and manage new technologies. Export-oriented plants also exhibit higher adoption rates, possibly because participation in global markets increases the pressure to innovate and improve efficiency. Unexpectedly, our analysis does not find a strong association of wage level or productivity and subsequent robot adoption. More productive or higher-wage plants do not seem to be more inclined to automate than others.

Workforce composition

Workforce composition is a key driver of robot adoption in Germany. Plants with a higher proportion of low-skill workers are more likely to adopt robots, as robots can efficiently substitute for routine tasks. Establishments with more high-skill employees adopt robots less frequently, since these workers typically perform complex, non-routine activities that are less amenable to automation.

Lack of skilled labor

Plants expressing a demand for further employee training are more likely to adopt robots. The positive association with training demand could indicate that a lack of skilled workers itself acts as an incentive for plants to consider automation. Robots are used to fill gaps in workforce capabilities. However, if plants experience more profound shortages of skilled labor, who are essential for operating and managing advanced machinery, robot adoption may be constrained. The data indicates that companies facing shortages of skilled labor are less likely to automate. Together, these findings highlight that workforce skills and labor market conditions are relevant factors in plants’ automation decisions.

How Does Robot Adoption Affect Labour Demand Within Factories?

Our German establishment-level data also allows us to study the effects of robot use on factory jobs. Most importantly, we find no negative employment effects in any particular occupational or age group. Robots may displace certain tasks, but they also create new employment opportunities, particularly for skilled and younger workers. We examine these effects by linking data on robot use with social security records and detailed occupational task descriptions. We find that robot adoption leads to an average increase of 5% in overall employment within an establishment. Moreover, plants that adopt robots experience a 24% rise in new hires during the year of adoption, particularly among technicians, engineers, and manager occupations characterized by non-routine, non-programmable tasks.

Younger workers benefit most from the introduction of new technologies, likely due to their greater adaptability and digital skills. Meanwhile, employment remains stable in low-skilled, routine-intensive occupations and among older workers, although these groups experience significantly higher turnover. This pattern suggests that robots tend to replace specific tasks rather than entire jobs, and that productivity gains from automation can support overall employment levels.

We further examine the gendered labour market outcome of robots and find that robot adoption yields a modest gain in female employment driven by increased hiring and accompanied by a substantial increase in job churning. The positive effect on female employment is concentrated on medium-qualified occupations and full-time workers.

Policy Implications

These results suggest that a shortage of young workers in low- and medium-skilled occupations may inhibit the widespread adoption of robotic technologies, potentially limiting the ability of robotics to address skilled labor shortages. At the same time, accelerated robotization may widen the gap between young and old workers. Younger employees are likely to find promising career prospects in modern, technology-driven establishments, while older workers may remain in smaller, less technology-intensive plants. These dynamics highlight the critical importance of lifelong learning and workplace training, particularly for equipping older employees with the skills needed to work alongside new technologies.

References

Deng, Liuchun, Steffen Müller, Verena Plümpe, and Jens Stegmaier. 2023. "Robots and Female Employment in German Manufacturing." AEA Papers and Proceedings 113: 224–28.

Deng, Liuchun, Steffen Müller, Verena Plümpe, and Jens Stegmaier. "Robots, occupations, and worker age: A production-unit analysis of employment." European Economic Review 170 (2024): 104881.

Deng, Liuchun, Verena Plümpe, and Jens Stegmaier. "Robot Adoption at German Plants." Journal of Economics and Statistics 244.3 (2024): 201-235.

Teaser picture credit: FANUC

A Journey Fueled by Curiosity

If you had told me as a child that I would one day be named one of the 10 Women Shaping the Future of Robotics, I’m not sure I would have believed you. But looking back, the signs were there from the very beginning.

Some of my earliest memories are of sitting beside my grandfather while he drew technical sketches by hand. He worked as a designer for a ball-bearing manufacturer, and I was mesmerized by his precision. These weren’t just lines on paper. They were plans. Codes. Maps of something bigger. I remember studying those blueprints for hours, captivated by the idea that machines could be imagined, designed, and then built to solve real-world problems.

That spark of curiosity never really left me.

Finding My Way Into Robotics

My path into robotics wasn’t a straight line. I started in engineering school, where I focused on food technology, but ultimately chose a different direction and became a journalist. Covering automation and industrial technologies brought me into contact with some of the brightest minds in the field, and I quickly found myself immersed in the world of robotics.

In 2014, I had the chance to meet Esben Østergaard and Enrico Krog Iversen, the founders of Universal Robots. Their vision stood out. They spoke not just about machinery, but about people. About collaboration. About how automation could be made accessible, not just for large industrial players, but for everyone. That moment stayed with me.

I knew I wanted to do more than just report on innovation. I wanted to be part of it. That decision led me to pursue an MBA in International Business Management and Leadership, and eventually into a new chapter at Universal Robots. Today, I lead the Ecosystem Success team for the EMEA region, helping partners across the UR+ ecosystem thrive and grow.

Making Work Better

What drew me to collaborative robotics was its human side. I’ve always believed that technology should make work better, not just faster. Robots shouldn’t replace people – they should help them. Make their jobs safer, more interesting, more meaningful.

I still remember visiting an ice cream factory two decades ago. Workers were manually packing ice creams into boxes for hours at a time. Today, robots handle that task, while the same people are running the equipment, writing programs, and monitoring systems. Their roles have changed for the better.

Since 2015, I’ve spoken at industry summits about the value of human-robot collaboration, even when collaborative robots were still relatively new. Topics like safety, usability, and real-world applications have always been important to me. Pushing the conversation forward has felt essential, and incredibly rewarding.

Communicating Robotics

My background in journalism continues to shape the way I work today. Communicating complex ideas in a clear and relatable way has always been a strength. Whether I’m speaking at events, contributing to industry publications, or participating in interviews, I see it as a chance to connect. To explain. To inspire.

Over the years, I’ve had the privilege of writing for magazines like Produktion, speaking on Germany’s Deutschlandfunk Kultur radio, and appearing at events such as the AI Tech Summit and Hispack in Barcelona. One of the highlights of my early career was editing the daily newspaper at Automatica in both 2012 and 2014. Fast-paced, high-pressure, and incredibly fulfilling.

I enjoy helping others understand the world of robotics. And I love showing how it connects to the world around us.

Encouraging Inclusion

Growing up, I never felt that being a girl interested in engineering was unusual. My parents encouraged me and my sisters to follow our interests, whatever they were. I didn’t see my gender as an obstacle.

But as my career progressed, I started to understand the power of visibility. When young women see someone like them working in robotics, it matters. It creates possibilities. I believe in being visible, in mentoring others, and in creating a space where people feel they belong.

At Universal Robots, I actively mentor and support women across the company. I see mentorship as a two-way street – an exchange of experiences, perspectives, and ideas. We all have something to learn.

To me, diversity isn’t just about gender. It’s about bringing together different mindsets, disciplines, and backgrounds. You don’t need to be an engineer to make an impact in robotics. Marketers, designers, strategists, and project managers all bring something valuable to the table. That’s where innovation really thrives – when we solve problems together in new and unexpected ways.

Looking Ahead

This is such an exciting time for robotics. Artificial intelligence is evolving rapidly, and we’re seeing robots used in completely new environments. From sorting blood samples in medical labs to transforming the world of filmmaking, the applications are expanding fast.

And of course, I wouldn’t mind seeing robots take over more of the boring household jobs. Folding laundry. Emptying the dishwasher. One day, maybe!

Outside of work, I enjoy restoring vintage items – furniture, electronics, anything with a bit of character. I love the process of bringing things back to life. I’m also a bit of a classic car enthusiast. Nothing beats a sunny day and a good drive in my vintage car with my family.

Selling refurbished items online has become a bit of a hobby too. It’s like running a mini business – pricing, descriptions, logistics. It keeps me sharp.

Final Thoughts

Being recognized by the International Federation of Robotics as one of the 10 Women Shaping the Future of Robotics is a huge honour. But more than that, it’s a reminder of why I chose this path in the first place.

I’ve seen how robotics can improve safety, boost productivity, and empower people in their work. That’s what keeps me inspired.

To anyone considering a career in robotics – especially young women – I’d say this: you belong here. Whether you’re an engineer, a communicator, a strategist, or a creative thinker, your skills and perspective are needed.

The future of robotics is collaborative. And there’s room for all of us in it.

Find out more about IFR's initiative "Women in Robotics".

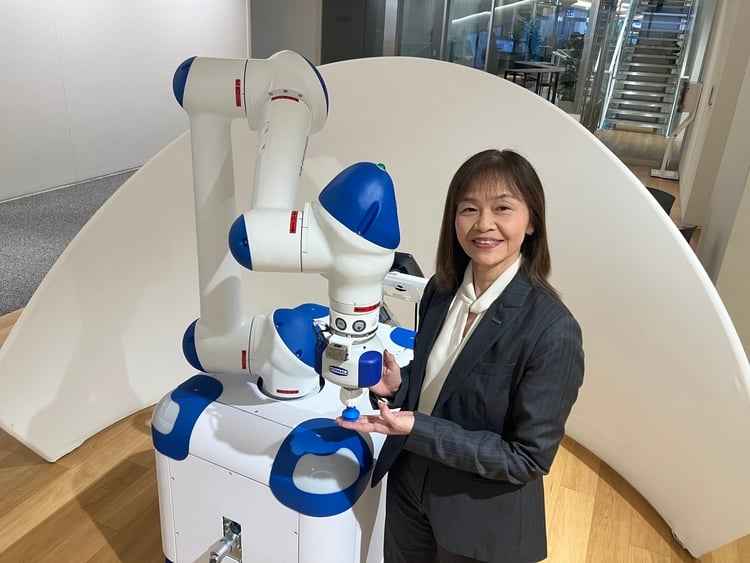

Yaskawa history

Yaskawa, the company I work at, was founded in 1915 and celebrates its 110th anniversary this year.

The company started in Kitakyushu City, a flourishing coal mining town, by providing motors and other electrical appliances to automate coal transportation. Our seniors' wish to make coal miners' labor as much easier as possible has been inherited as our DNA, and we have driven the electrification and automation of production sites with motors as the core since 1915.

Yaskawa commercialized the world's first servo motor in 1958. We then shifted our activities to mechatronics. (As a side note, the phrase "mechatronics" was originally created by Yaskawa in 1969. At the time, it was registered as a trademark, but soon released and is now commonly used.)

In 1977, we released Japan's first all-electric robot MOTOMAN-L10, which embodies mechatronics. Over the past 50 years, the company has developed robots that are adaptable to a wide range of applications. Today, there are approximately 200 models and more than 600,000 units shipped. This is exactly the progress of the global robotics business from the birth of robots.

My own path

I studied computer science at university, and after joining Yaskawa in 1991, I spent much of the time working in the Robot Division to develop software for robot controllers. Specifically, I worked on the development of programming pendants for human operation of robots and the opening function of robot controllers.

YASKAWA launched i³-Mechatronics concept to realize innovative automation solutions by using on-site automation and data generated from it in 2017. I led the development of YASKAWA Cockpit, the core product of i³-Mechatronics.

In 2019, I was appointed president of AI Cube, a subsidiary of Yaskawa. AI Cube specializes in AI in the manufacturing field. We have positioned AI as a tool to make effective use of on-site data, and are making various efforts to realize our vision of "creating a world where AI is used as a standard in manufacturing. "

In FY 2025, the “AI Robotics Division” was newly organized to aggressively promote AI × Robotics. As the general manager of this division, I am actively promoting the initiative to speed up automation in areas where automation has not been possible until now through "AI × Robotics.".

In my childhood, I wasn't particularly keen on robots, but was good at arithmetic.

And I loved thinking and creating something new. This isn't just electrical stuff, for example, cooking or small pieces of furniture. Of course, there were a lot of failures, but I often created what I wanted by imagining myself. I feel that I am able to develop AI today because of my background in computer science and software development, in addition to my craftsmanship. Being at the forefront of this new field of AI robotics, I myself have experience in the development of robots and working at customer sites where robots are installed, and I understand the difficulty and hardship of introducing the technology to the site, and I am exploring the market as an exit, which is my great motivation.

Our development is based on actual technologies and products that customers can use, not in the labs. That's why I feel a great responsibility, but I think that the keyword AI robotics will be more practical in society by greatly expanding the capacity of what can be done with industrial AI.

In the early days, the spotlight wasn't on controllers or software, but on hardware like arms. However, in the context of AI robotics, it has become clear that the true nature of quality must be determined in the controller, which represents the brain.

There are already many places where automation has been in progress, but automation has yet to be achieved for various reasons in markets such as food, construction, and agriculture. I hope that the use of AI tools will further promote automation and contribute to the development of society.

Yaskawa Principles state that people should live a safe, secure and humane life in society, and I believe that we can move toward this realization by faithfully implementing these goals.

In everything from running AI Cube, operating AI Robotics Division for new initiatives, and exploring the new field of unautomated areas, I am taking on challenges based on the wishes of my senior colleagues and DNA that has been inherited even now. Going forward, I will continue to keep an eye on the development of AI× robotics, as well as on motors, which are the origin of AI× robotics, and move toward new areas of automation with an always positive mind.

Thank you for your continued support.

Find out more about IFR's initiative "Women in Robotics".

Kateryna Portmann – Visionary Leader in Robotics, AI, and Ethical Innovation

Kateryna Portmann is a visionary leader at the forefront of robotics and AI governance. As a Senior Product Manager at ANYbotics, a global pioneer in autonomous legged robots for industrial inspection, Kateryna plays a key role in shaping the responsible development and deployment of AI-powered robotics. She leads the Sandbox AI collaboration, fostering innovation across industries, and is spearheading ANYbotics’ ISO 42001 initiative, aiming to set a global benchmark in AI management systems.

Her work bridges technical innovation and ethical leadership, ensuring that intelligent systems are built on trust, transparency, and accountability. Kateryna’s commitment to responsible AI is demonstrated through her leadership of the AI Governance Roundtable at AI House Davos, where she brought together thought leaders from across sectors to shape the future of responsible AI.

In addition to her role at ANYbotics, Kateryna is the newly appointed Lead of the Robotics Initiative at Women in AI Governance, where she advocates for ethical innovation in robotics. She is also honored as one of the Women in Robotics – Share the Future 2025 by the International Federation of Robotics, recognizing her profound impact in advancing inclusive and human-centric technology.

Driven by a mission to ensure that robotics and AI solve real-world problems with integrity, safety, and purpose, Kateryna continues to push the boundaries of what’s possible, blending cutting-edge technology with ethical practices.

My Motivation: A Childhood Dream in Robotics

Hello, my name is Kateryna Portmann, and I am truly honored to be recognized as one of the women shaping the future of robotics. My journey into this field began in Ukraine, where I was raised in an environment where there were no limits on what boys and girls could achieve. For me, math was not just a subject to study—it was celebrated. From an early age, I was fascinated by how things worked, especially robots. I didn't see any gap or societal expectation telling me that robotics or technology weren’t for girls.

I grew up dreaming of robots as toys, while others might have been focused on dolls and teddy bears. I wanted to understand the mechanisms behind how these robots moved and worked. Yet, despite my strong desire for technology-focused toys, I ended up with the usual, non-technical gifts. But even so, I never let that stop me. I found ways to explore and learn on my own. I was determined to follow my passion for technology, and as I look back, I realize that this curiosity fueled my entire career.

Why Robotics?

Choosing robotics was natural for me. It was more than just a hobby; it was a calling. I wanted to combine my love for technology with the potential to create real change in the world. Robotics has always fascinated me because it sits at the intersection of hardware and software, of engineering and creativity. There’s a magic in seeing an idea come to life—seeing something that once existed only in the imagination being brought to reality through innovation.

When I started my academic journey, the world of robotics was still emerging. Back in the early 2000s, robotics wasn’t as widely accessible as it is now. The technology was not as advanced, and fields like AI (artificial intelligence) were still in their early stages. It was an exciting time, but also a time of uncertainty for me as a young woman entering a male-dominated field. I began to face subtle biases, with some people questioning whether robotics and engineering were “appropriate” professions for women. These doubts crept in, and for a while, I started to believe that I might not belong in this world.

But deep down, I knew that robotics needed people from all backgrounds. It needed diversity, creativity, and unique perspectives. Even though I wasn’t studying engineering, I realized that I could contribute to the field in my own way. Robotics isn’t only for engineers—it’s about creating solutions for people. My passion for technology led me to focus on the intersection of technology and human needs, which led me to my current role in product management.

A Non-Technical Path in Robotics

In my career, I chose a different route to contribute to the field. Instead of becoming an engineer, I decided to become a Product Manager in robotics. This choice allowed me to leverage my background in management and strategy, where I focus on understanding user needs, market demands, and how technology can create meaningful, human-centered solutions.

In robotics, engineers develop the technology, but non-technical Product Managers play a vital role by ensuring the technology is accessible, relevant, and impactful. As a Product Manager, I focus on ensuring that the technology developed doesn’t just exist for the sake of innovation but serves real people in practical, tangible ways. This role requires creativity, empathy, and communication—skills that, although not rooted in technical expertise, are just as important in the world of robotics.

The beauty of product management in robotics is that we get to see how technology can truly transform lives. It’s about understanding how the tech can help improve everything from healthcare to manufacturing to personal mobility. Even if I wasn’t designing robots, I knew I could help make them work better for people. And this realization gave me the clarity to push forward with confidence.

What Inspires Me: Changing the Narrative for Women in STEM

As I moved forward in my career, I became increasingly aware of the significant underrepresentation of women in the STEM fields, particularly in robotics. This inspired me to take action. I realized that diversity is essential to innovation and that women have a unique role to play in shaping the future of technology. I’m proud to be actively involved in initiatives like Women in Robotics, where we work to create more opportunities for women and girls in the field.

Through programs like the World Robotics Olympiad and the Girls Award, I support initiatives aimed at encouraging young girls to pursue STEM and robotics. I’ve also written an inspirational book designed to show young girls that they, too, can succeed in robotics and technology. When I look at young girls eager to explore technology, I see a bright future—a future where girls are no longer discouraged from entering these fields but are instead inspired to lead.

One of the most fulfilling moments in my journey came when I brought my younger sister to a Future Day event at ANYbotics, the company I work for. Watching her eyes light up as she learned about robotics firsthand reminded me of the importance of early exposure and mentorship. It reinforced my belief that the future of technology is shaped by those who are given the right tools, guidance, and inspiration from the start. This is why I remain so passionate about opening doors for young girls and showing them that they can build a future in technology.

Lifelong Learning: Embracing AI and New Technologies

One of the things that continues to inspire me about robotics is how rapidly the field is evolving. When I first started, AI was still in its infancy. Now, it’s a driving force behind much of what we do in robotics, and it has the potential to revolutionize entire industries. While AI wasn’t something I could have studied in-depth back in the early 2000s, I’ve seen how it has transformed the landscape of robotics—and I’m excited about the possibilities it holds for the future.

What excites me most about AI and robotics is that there’s always something new to learn. Technology is always advancing, and the only way to stay relevant is through lifelong learning. I embrace this as a core principle of my career and personal development. In fact, AI and robotics are fields where continuous learning is not just a choice but a necessity. The knowledge I have today may become outdated tomorrow, and that’s why I continue to invest in learning, staying curious, and adapting to new technologies.

This is a message I want to share with others, especially young women: Never stop learning. The world of technology is constantly changing, and so should we. If you are passionate about something, keep learning. Keep growing. The opportunities are endless.

Balancing Career and Family: You Can Have It All

A challenge many women face, especially in the tech industry, is balancing career aspirations with family life. I want to address this directly: You don’t have to choose between family, children, and a successful career. I know the pressures women face to “pick one,” but it is possible to build a fulfilling career in robotics and technology while maintaining a happy family life. I’ve learned that finding the right balance comes from prioritizing what matters most and seeking support when necessary. You don’t have to do it alone, and it’s okay to ask for help.

As women, we can break down the stereotypes that limit us. We can excel in both our professional careers and our personal lives. The key is to understand that you don't have to sacrifice one for the other. With determination, support, and a willingness to adapt, we can achieve both.

Conclusion: Shaping the Future of Robotics Together

Looking ahead, I see a world where women are not just participants in the tech and robotics industries—they are leading them. The field of robotics needs women’s creativity, empathy, and diverse perspectives. Technology isn’t just about coding and engineering; it’s about creating solutions that make life better for everyone. Robotics is about innovation for humanity, and women have so much to offer in shaping this future.

I am deeply honored by the recognition I’ve received, but what motivates me most is the opportunity to pave the way for the next generation of women in robotics. I am committed to ensuring that every girl, every woman, knows that they have a place in this field and that they can shape the future of technology. The world of robotics is waiting for your ideas, your innovations, and your leadership.

Thank you.

Find out more about IFR's initiative "Women in Robotics".

What motivated me to choose a career in robotics?

I was approached about a specific role in ABB Robotics and at that time my impression of the field was that it was highly technology orientated to enable high levels of automation in different manufacturing environments. However, after joining the industry, I discovered that while it is about that it aims for so much more—an opportunity to enhance our lives at work and within society. The most impactful innovations in robotics stem from a blend of technological advancements, cost-effectiveness, efficiency gains, and safety benefits.

Biggest Inspiration and My Career Path

Early in my career, I worked as an R&D engineer in micro-electronics across China and Germany. In 2006, I transitioned to an HR role, focusing on talent management and organizational development. Since joining ABB Robotics R&D in 2017, I've held various positions both globally and locally. Two years ago, I began my current role as the Head of R&D in China.

Robotics integrates multiple technologies, including mechanical, electronics, and software development, making teamwork essential. Experts from diverse disciplines collaborate to design, build, and program robots, each contributing their unique expertise to the project's success. I enjoy working closely with my colleagues, asking questions, and fostering a safe and empowering environment for our teams.

I strongly believe in lifelong learning, which allows me to continuously expand my knowledge, skills, and perspectives. By staying curious and open to new ideas, we can enrich our understanding of the world and adapt to the ever-changing landscape of technology and innovation. I learn new skills every day through project meetings and technical discussions, and the endless opportunities for learning in robotics are truly fantastic.

Supporting Women and Girls to Choose Careers in STEM and Robotics

Despite the growing number of women in China’s scientific community, now at around 40 million, women remain underrepresented in leadership positions, accounting for only 10 percent.