In the last six years, (2010-2015), the US industry has installed around 135,000 new industrial robots. The principal driver in this race to automate is the car industry. During this same period, (2010-2015), the number of employees in the automotive sector increased by 230,000.

Today, the robot density in the automotive sector of the United States rank second worldwide to that of Japan. The industrial renaissance in North America continues unabated; provided the global economy remains stable, it is estimated that robot shipments to Canada, Mexico and the US will grow at an average annual rate of 5% to 10%.

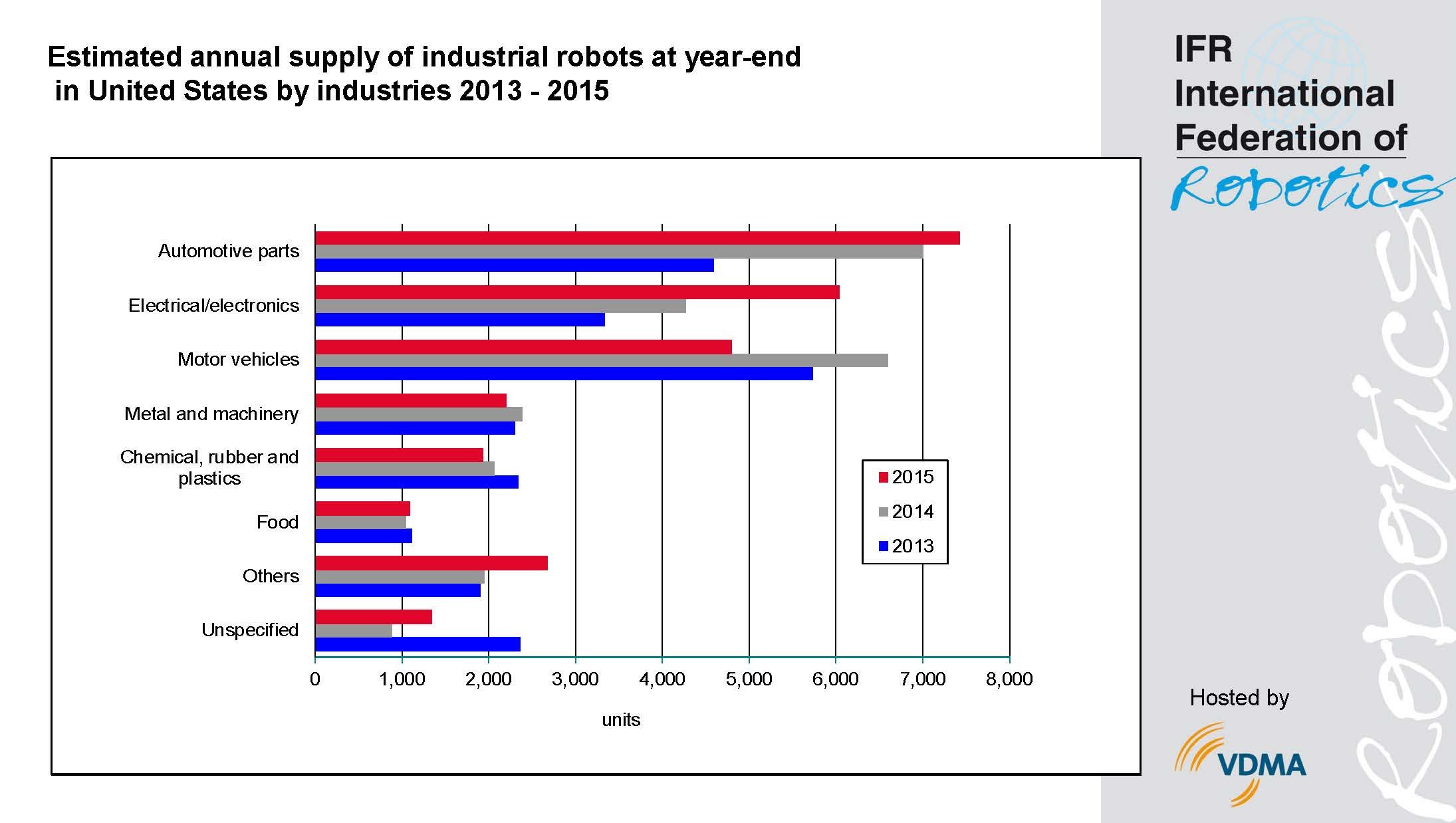

The industrial sector in the US continues to invest strongly in robotics and automation. At 27,500 units in 2015, the number of newly installed industrial robots has more than tripled since the financial crisis of 2009. The main driver of this growth is the ongoing trend to automate production in order to strengthen the competitiveness of American industry globally, to keep manufacturing at home, and, in some cases, to bring back manufacturing that had previously been outsourced to other countries.

The US automotive industry is leading the automation charge: between 2010 and 2015, more than 60,000 industrial robots were installed in the United States. Only in China were there more industrial robots installed during the same period - almost 90,000 units. The carmakers in the US have successfully restructured their businesses following the economic and financial crisis in 2009; General Motors, the top manufacturer of cars and light vehicles in the US, further stabilized its market share in 2015, as did Ford Motor Company. Automation has played a critical role in enabling European and Asian car manufacturers and automotive parts suppliers to expand their capacities in the US and to invest in the modernization of their existing facilities. The robot density in the United States increased to 1,218 robots per 10,000 employees in the automotive industry in 2015 (Japan = 1,276; Korea = 1,218; Germany =1,147; France = 940 robots per 10,000 employees).

Car manufacturers and component suppliers will continue to be heavy users of robots. In addition, more and more new companies specialized in electric or autonomous vehicles are starting up in the United States and are in need of modern and efficient production facilities. This said, after six years of continuously growing industrial robot sales to the US automotive industry, a moderate decrease in the overall sales growth is anticipated for 2016 - 2017; the retooling necessary for new car models will then drive an increase in demand for industrial robots starting in 2018 - 2019.

The electronics industry continues to be the fastest-growing emerging industry forindustrial robots in the United States (2014-2015 = +41%). Increasing numbers of orders can also be expected from the metals and machinery industry, the rubber and plastics industry, the pharmaceutical and cosmetics industry, and the food and beverage industry. Changing customer demands necessitate the modernization and expansion of capacities which, combined with local industry’s need for automation to strengthen its competitiveness, will lead to further increase in demand for industrial robots.

“The rapid rise of robot use in the United States is impressive for several reasons,” said Jeff Burnstein, President of Robotic Industries Association. “First, we’ve seen the industry’s largest user, the automotive industry, accelerate its purchases of robots and at the same time create more jobs in the manufacturing process. Second, we’ve seen strong growth in the use of robots in general industry, as robots further penetrate industries such as life sciences, warehousing, and semiconductor and electronics manufacturing. Finally, the use of robots is rising in small and medium sized companies who see robotics as a key factor in improving productivity and product quality in order to stay globally competitive. We expect these trends to continue well into the future,” Burnstein explained.