World Robotics Report 2016

European Union occupies top position in the global automation race

By 2019, more than 1.4 million new industrial robots will be installed in factories around the world - that’s the latest forecast from the International Federation of Robotics (IFR).

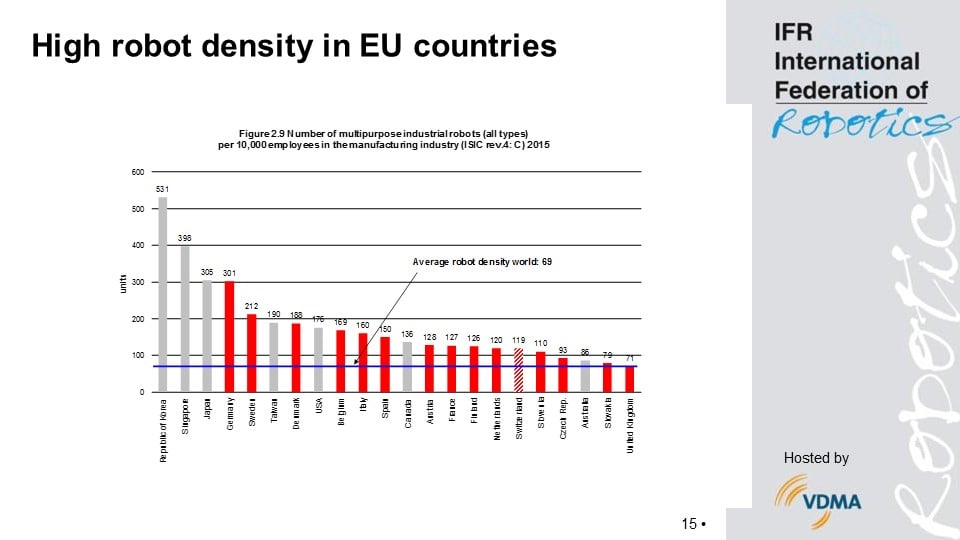

In the race for automation in manufacturing, the European Union is currently one of the global frontrunners: 65 percent of countries with an above-average number of industrial robots per 10,000 employees, are located in the EU. The strongest growth drivers for the robotics industry are found in China; however, in 2019 some 40 percent of the worldwide market volume of industrial robots will be sold there alone. So says the 2016 World Robotics Report, as published by the International Federation of Robotics (IFR).

“Automation is a central competitive factor for traditional manufacturing groups, but is also becoming increasingly important for small and medium-sized enterprises around the world”, says Joe Gemma, President of the International Federation.

The industrial robots boom 2019

The number of industrial robots deployed worldwide will increase to around 2.6 million units by 2019. That’s about one million units more than in the record-breaking year of 2015. Broken down according to sectors, around 70 percent of industrial robots are currently at work in the automotive, electrical/electronics and metal and machinery industry segments. In 2015, the strongest growth in the number of operational units recorded here was registered in the electronics industry, which boasted a rise of 18 percent. The metal industry posted an increase of 16 percent, with the automotive sector growing by 10 percent.

European Union well on course towards automation - China making up ground

The strongest growth figures in Europe are being posted by the Central and Eastern European states - the rise in sales was about 25 percent in 2015. Also 2016 a similar growth rate is forecasted (29 percent). The positive trend is expected to continue. The average growth will remain steady at around 14 percent per year (2017-2019). The biggest climbers in sales of industrial robots are the Czech Republic and Poland. Between 2010 and 2015 the number of new robot installations climbed in the Czech Republic by 40 percent (compound annual growth rate) and in Poland by 26 percent (CAGR).

In a worldwide comparison, the European Union member states as a whole are particularly far advanced regarding automation. This is evident from the robot density existing in the automotive industry, for example. Half of the top 10 nations with the most industrial robots per 10,000 employees belong to the European Union. The highly developed nature of automation in Europe is also clear from looking at the manufacturing industry. Of the 22 countries with an above-average robot density, 14 are located in the EU. The robot density in the big Western European economies is still currently ahead of up-and-coming China. The largest gap in this respect is with Germany (301 vs. 49 units) ? the smallest being with the United Kingdom (71 vs. 49 units).

China, the market for growth

With a national 10-year plan - entitled “Made in China 2025” - the country is aiming to become one of the top technological industrial nations within just a few years. However, in order to achieve Beijing’s target of a robot density of 150 units by 2020, some 600,000 to 650,000 new industrial robots will have to be installed throughout China. By comparison: Around 254,000 units were sold in the global market during 2015. Nevertheless, today China is already a leading sales market. At around 68,600 units sold, the statistics for 2015 were 20 percent above the previous year’s figures, thereby exceeding the volume of sales for all European markets combined (50,100 units). Total sales will increase by 30% in 2016 and between 2016 and 2019 by 20% on average to more than 400,000 units in 2019. This will be 40% of the total sales in 2019.

The Republic of Korea and Japan come in second and third place, as the world’s largest sales markets for industrial robots. The number of units sold in 2015 grew by 55 percent in the Republic of Korea, and by 20 percent in Japan. Together with Singapore, these two countries lead the rankings of the global automated economies for robot density in manufacturing. With a stable economic situation, it may be expected that both Korea and Japan will see average annual growth of 5 percent in sales of robots from 2016 to 2019.

North America on path to success

The USA is currently the fourth largest single market for industrial robots in the world. Within the NAFTA area (USA, Canada and Mexico), the total number of newly installed industrial robots rose by 17 percent to a new record of some 36,000 units (2015). The leader of the pack was the USA, accounting for three-quarters of all units sold. 5 percent growth was recorded. With a comparatively much smaller amount of units, the demand in Canada increased by 49 percent (5,466 units), while that in Mexico grew by 119 percent (3,474 units). With a stable economic situation, it may be expected that North America will see average annual growth of 5 to 10 percent in sales of robots from 2016 to 2019.

The USA plays a leading role when it comes to automation in the automotive industry. US car makers are ranked third in robot density, behind Japan and the Republic of Korea. The US automotive industry has performed well over the last six years. 2015 proved to be the most successful year since 2005. Major manufacturers from the US, Europe and Asia embarked on restructuring programmes resulting in the installation of some 80,000 industrial robots between 2010 and 2015. This is the largest investment worldwide, second only to China at around 90,000 units. This commitment is reflected in the increasing number of new jobs: The number of people employed in the automotive sector grew by around 230,000 between 2010 and 2015.

Robots and jobs

The enormous automation programmes with robots had a positive effect on employment not only in the US. In the German automotive sector, the number of employees likewise increased parallel to the growth of robotic automation: The increase between 2010 and 2015 averaged 2.5 percent - the operational stock of industrial robots showed a parallel increase averaging three percent per year. The positive effect of automation on the number of jobs is confirmed by a study recently published by the ZEW, in partnership with the University of Utrecht. In essence, reduced production costs result in better market prices. The increasing demand then triggers more jobs.

Outlook 2019

By the end of 2016, the number of newly installed industrial robots will have increased by 14 percent to 290,000 units during the year. For 2017 to 2019, continued growth averaging at least 13 percent per year is forecasted (CAGR). Robotics manufacturers have made preparations for these kinds of growth prospects. To this end, production capacities have been increased, and the majority of European manufacturers are operating new locations in the large sales markets of China and the USA.

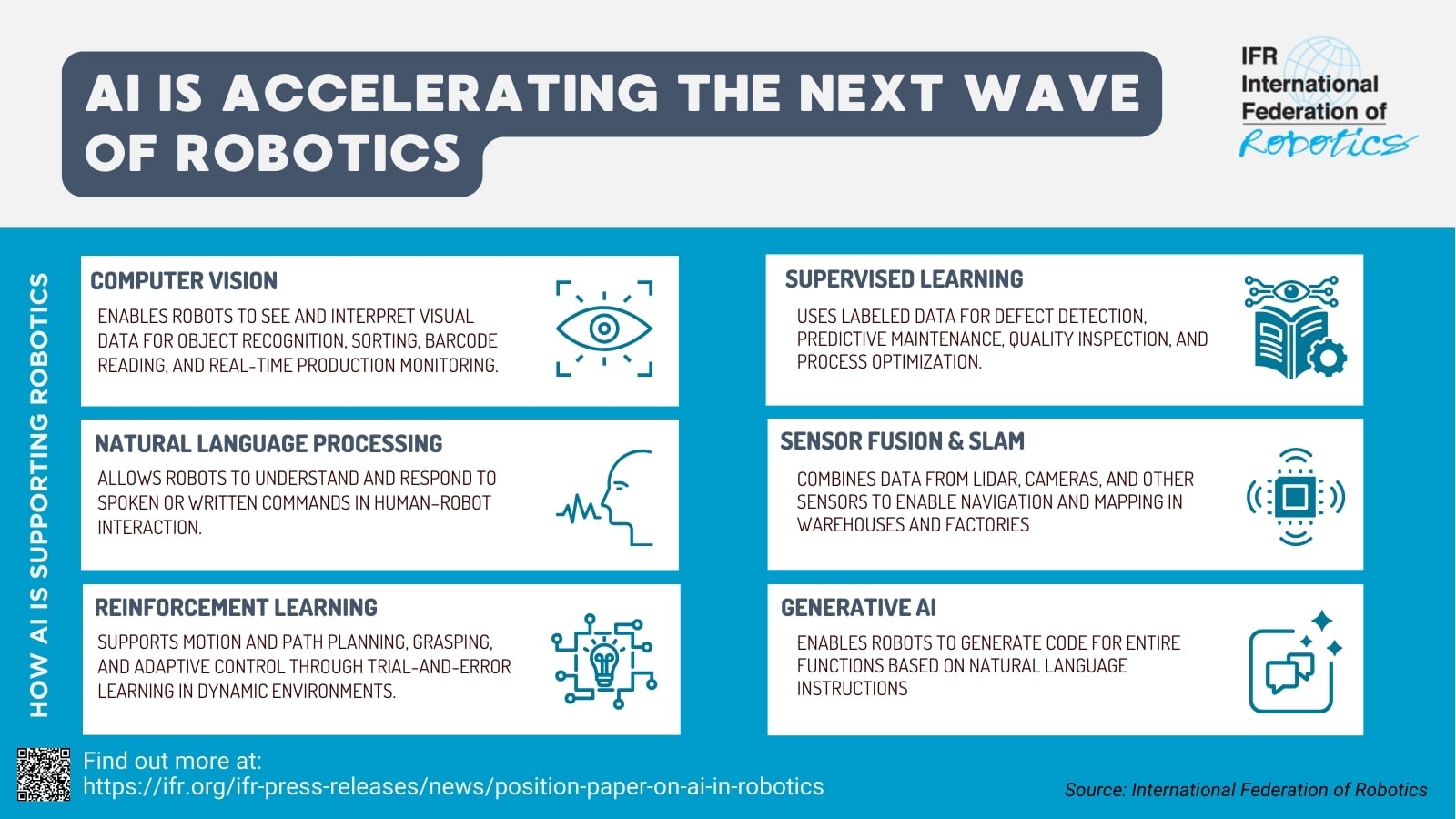

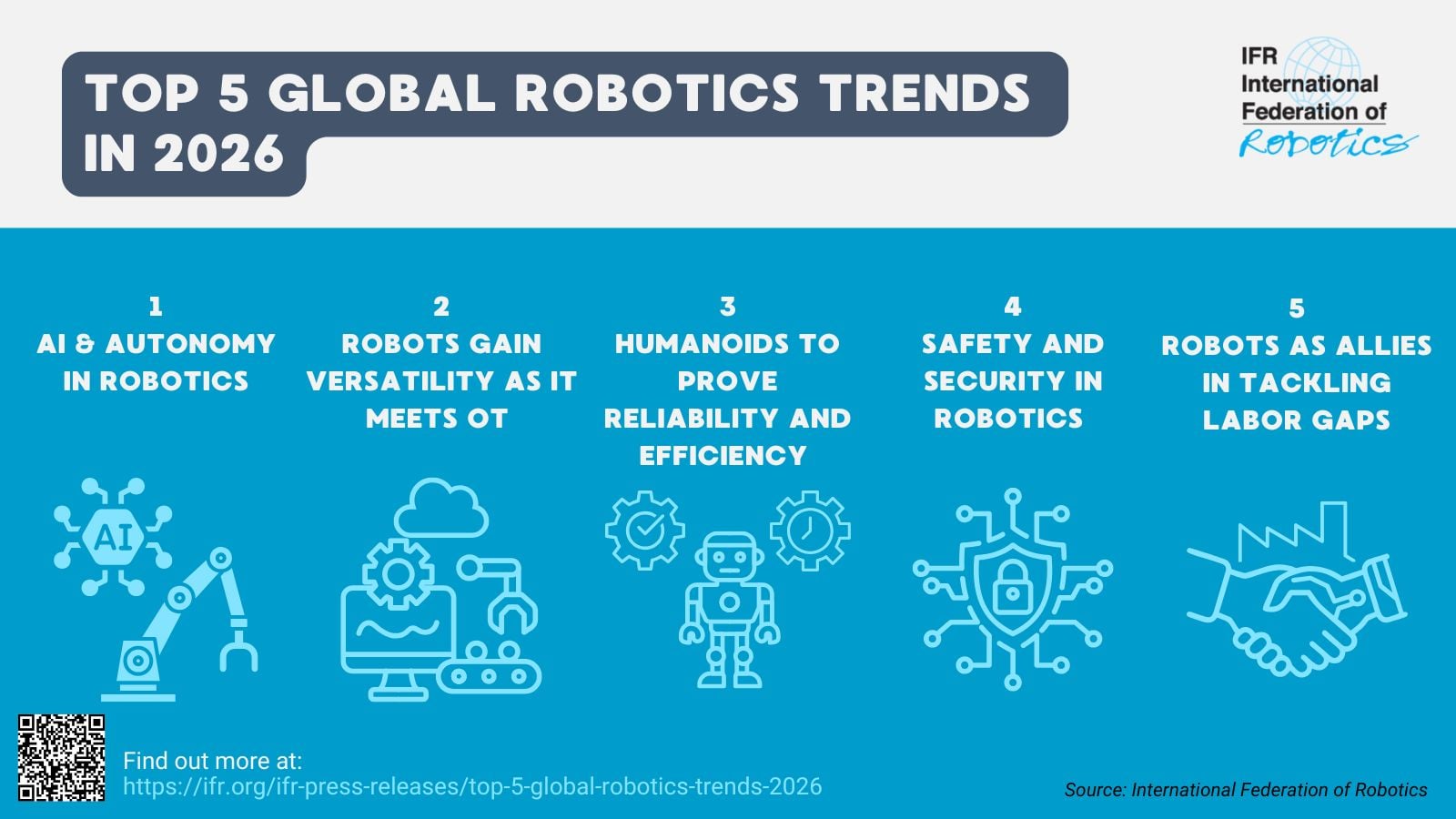

As far as technological trends are concerned, companies will, in the future, be concentrating on the collaboration of human and machine, simplified applications, and light-weight robots. Added to this are the two-armed robots, mobile solutions and the integration of robots into existing environments. There will be an increased focus on modular robots and robotic systems, which can be marketed at extremely attractive prices.

The demand among customers for industrial robots will likewise be driven by a whole assortment of factors. This includes the handling of new materials, energy efficiency, better developed automation concepts, enabling the real-world factory and the virtual world to be interlinked with one another, as per the definition of Industry 4.0 and the Industrial Internet of Things.

- 2016-09-29_Press_Release_IFR_World_Robotics_Report_2016_ENGLISH.pdf (146KB)

- 2016-09-29_Pressemitteilung_IFR_World_Robotics_2016_deutsch.pdf (149KB)

- Presentation_market_overviewWorld_Robotics_29_9_2016.pdf (570KB)

- Presentation_Industry_i4.0_Rob_Alexander_VERL_29_9_16.pdf (1.05MB)

- IFR_Industrial_2016_web.jpg (28KB)

- Contents World Robotics 2016 - Industrial Robots (29KB)

- Foreword_WR_Industrial_Robots_2016.pdf (26KB)

- Executive Summary World Robotics Industrial Robots 2016 (69KB)

- RTEmagicP_Robot_density_2015.jpg (70KB)

- Annual_supply_2005_2019.jpg (78KB)

- Operational_Stock_2019.jpg (62KB)

- Fanuc_Lambrechts-Haacht-1600x560-02.jpg (1.02MB)

- Kawasaki_packaging_solution.jpg (2.18MB)

- Kuka_KR_QUANTEC_Boll_Automation__4__.JPG (1.79MB)

- Alexander_Verl_2016.jpg (253KB)

- Joe Gemma landscape format (288KB)