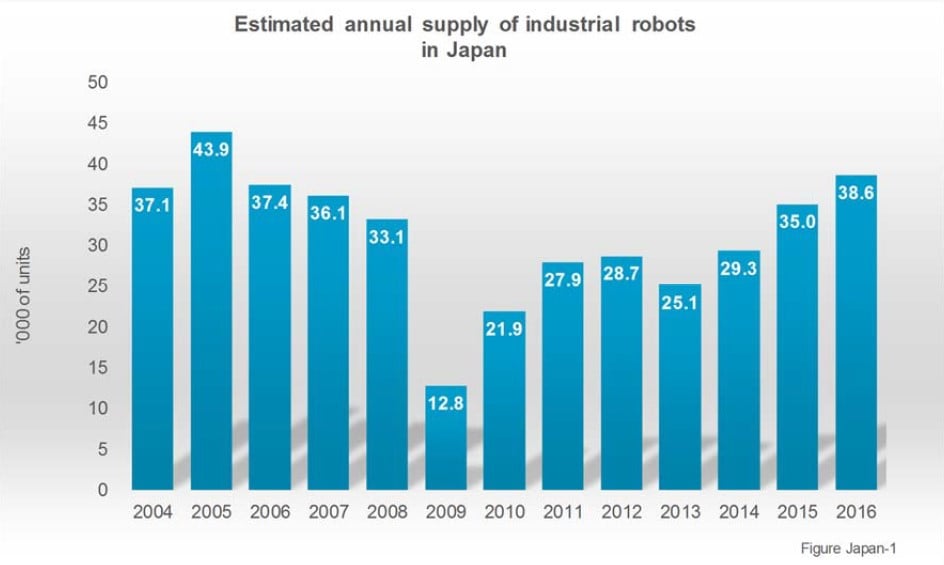

Robots: Japan delivers 52 percent of global supply

Japan is the world´s predominant industrial robot manufacturer

Robot sales in Japan reaching the highest level since 2006

“Japan is a highly robotized country where even robots are assembled by robots”, said Joe Gemma, President of the International Federation of Robotics (IFR). “The statistics show that automation strongly boosts exports and domestic investments as well – robot sales in Japan increased by 10 percent to about 39,000 units in 2016 - reaching the highest level in the last ten years.”

Japan´s high export rate

Japan exported a total of nearly 115,000 industrial robots in 2016 with a value of 309 billion yen (about US$ 2.7 billion). This is by far the highest export volume for one year. The export rate increased from 72 percent to 75 percent (2011-2016). North America, China, the Republic of Korea and Europe were target export destinations. The Japanese imports of robots were extremely low, only about 1 percent of installations. Thus, foreign robot suppliers did not achieve a high sales volume in Japan. The home market has strongly recovered since the financial crisis in 2009 and reached 39,000 units, the highest level since 2006 (37,000 units).

Car- and electrical/electronics industry dominate

The automotive industry is the largest destination market for industrial robots in Japan with a share of 36 percent of the total supply. Car manufacturers bought 48 percent more industrial robots than in 2015 (2016: 5,711 units). Japanese car suppliers are leading in the production of hybrid cars and will increase investments in automated driving technologies. The development of new materials which reduce weight and save energy will also foster investments in robot automation. However, the ongoing reduction of production capacities in Japan will impact domestic demand for robots. Investments abroad, on the other hand, will continue to increase. The Japanese car companies have been increasingly expanding production facilities overseas, particularly in China, as well as other Asian countries and in the United States and Mexico.

After the strong growth of robots in the electrical/electronics industry in 2015 (11,659 units), a decrease of 7 percent followed in 2016. However, the electrical/electronics industry has preferred to invest in production facilities abroad. Furthermore, continued investments in robots can be expected in this sector with the increasing demand for chips, displays, sensors, batteries and other technologies around electro mobility, and industry 4.0 (connected industries).

The two most important customer groups of industrial robots in Japan - automotive and electrical/electronics - had jointly, a share of 64 percent of the total supply in 2016. Robot sales to both sectors increased by 8 percent in 2016. In all other branches, as a whole, the market increased by 14 percent.

Japan outlook 2020

In Japan, the economy benefits from increased foreign demand, especially from China, the expansive monetary policy of the Bank of Japan and the weaker yen. Based on estimates provided by the Japanese Robot Association (JARA), the IFR expects an increase of around 10 percent in 2017 in domestic installations. Between 2018 and 2020 a further average annual increase of about 5 percent is likely, provided the economic recovery in Japan continues.

IFR Japan data overview

Please find below an overview of the new IFR data about industrial robots in Japan:

Japan – new peak in 2016

Sales

- 38,586 new robots installed (new record), 10% higher than in 2015

- CAGR 2011-2016: +7%

- Global ranking 2016: No. 3

- Shares of total supply: Handling operations 36%, welding 22%; Automotive industry 36%, electrical/electronics industry 28%

Stock of operational robots

- About 287,300 units, slight increase over 2015 (286,600)

- CAGR 2011-2016: -1%

- Global ranking 2016: No. 2

- Shares of total stock: Handling operations 36%, welding 23%; Automotive industry 35%, electrical/electronics industry 31%, metal and machinery industry 10%