Sales of service robots for professional and domestic use continue to boom, despite the economic downturn. In fact, economic uncertainty is one of the factors driving an increase in professional service robot sales, as logistics and manufacturing companies and hospitals turn to robots to smooth out the impact of unpredictable demand on labour requirements, and support staff in service sectors with labour shortages. Meanwhile, rapid technology advances are driving sales in high-value markets such as medical robots.

Logistics robots capture largest share of unit sales of professional service robots

Logistics robots captured the largest share of unit sales, accounting for 43% of 2019 sales of professional service robots. Logistics robots are increasingly expanding their reach from service sectors into manufacturing. As we discuss in the recent paper, How Connected Robots are Transforming Manufacturing, autonomous guided vehicles (AGVs) are increasingly used to transport materials and parts to and from production lines while robots on mobile platforms can feed computer-numerically controlled (CNC) machines.

The category of mobile robots saw strong growth of 25% in unit sales in 2019 over the previous year. Like AGVs, mobile platforms can navigate around indoor spaces based on an internal map that is updated in real time, allowing the robot to ‘see’ obstacles and replan its path around them. Almost anything – from storage containers used in hospitals, to robot arms used to feed machines – can be placed on the mobile platform. Mobile robots have been used extensively in the current COVID-19 pandemic to deliver supplies in hospitals and support doctors in performing temperature and other checks. The versatility of mobile platforms makes this the strongest professional service robot growth sector. The IFR forecasts 97% average annual growth in unit sales in this category between 2020 and 2023.

Robots for public environments second fastest-growing category

Robots for public environments is the second fastest-growing professional service robot category in terms of unit sales, with a 44% increase in 2019 over 2018. These robots are typically used in hotels and restaurants, in public environments for guidance and information outlet, in stores or other public environments to promote sales or services, or as robot attractions such as joy rides. In hotels, robots carry suitcases to rooms, deliver room service, transport laundry, and greet guests. Information robots are used in a variety of public places, such as airports, to assist passengers in finding their gate number or shops to guide customers to the required product. Robots can also be used in restaurants to prepare and serve food and transport returned trays.

COVID-19 drives strong sales forecast for cleaning robots

The COVID-19 pandemic has also driven sales in professional cleaning robots. Cleaning robots have been used to disinfect hospitals, public transport and supermarkets (see a variety of case studies here).The IFR forecasts that professional cleaning robots will be the second fastest-growing a professional robot sector in terms of unit sales - at 41% on average between 2020 and 2023.

Rehabilitation robots show promise, from small market base

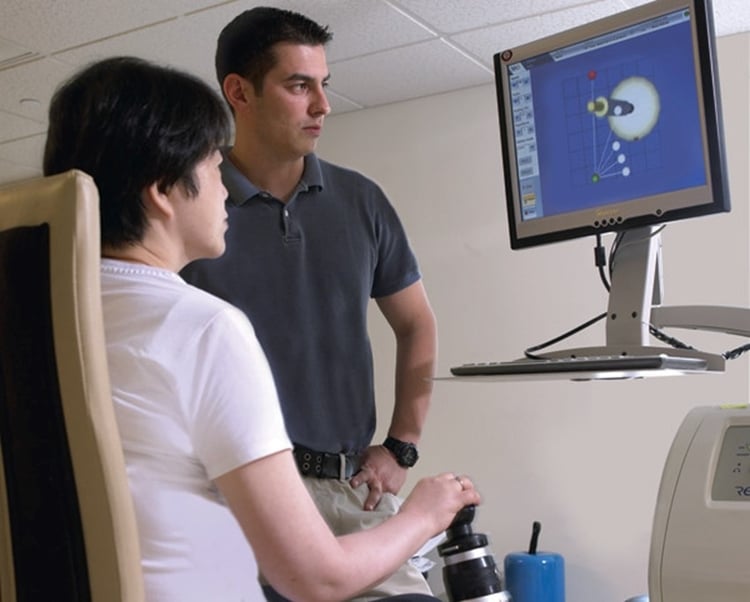

Medical robots were the third fastest-growing category of robots (after robots for public environments and logistics robots) with a 33% increase in unit sales in 2019. Rehabilitation robots demonstrated particularly strong growth, with a 45% increase in unit sales. As we explore in recent case studies, the increasing sophistication of vision systems and data analytics means that robot-assisted rehabilitation generally produces better outcomes than purely manual rehabilitation, and frees rehabilitation professionals to focus on developing rehabilitation strategies and providing psychological support to patients. The IFR expects an annual average growth rate of 37% in unit sales of rehabilitation robots between 2020 and 2023.

Robots used for inspection and maintenance

Inspection robots was the fourth largest sector of professional robots in 2019 in terms of unit sales. Almost 15,000 inspection robots were sold, an increase of 32% over 2018. Growth in sales of inspection robots is largely driven by advances in robot vision and analytics technologies. Robots can be trained to recognise faults and sophisticated 3D vision systems result in a very high rate of accuracy in detection. The IFR forecasts steady growth in average annual unit sales of 27% between 2020 and 2023.

Sales of robot vacuum and floor cleaners boom

Sales of robots for personal and domestic use are dominated by robot vacuum and floor cleaners which accounted for 93% of unit sales of robots for domestic tasks in 2019. Going forward however, the category of robots for window cleaning, home security and surveillance and the category of robot companions, assistants, humanoids and multimedia are forecast to show strongest growth in unit sales, each with a forecasted average annual increase of 56% between 2020 and 2023.

The market for entertainment robots appears to be relatively mature, with only 10% annual average growth in unit sales forecast in this sector between 2020 and 2023.

European manufacturers dominate service robot market

Whereas production of industrial robots is dominated by Japanese manufacturers, the production of professional and domestic service robots is far more diverse. Of the 899 service robot companies captured in the IFR’s 2019 World Robotics Report – Service Robots, 49% are from Europe, 29% from North America, and 21% from Asia. American companies are strong in logistic systems whereas European manufacturers dominate in medical robots. Asian manufacturers are stronger in the category of field robots. The market is extremely vibrant – 23% of service robot manufacturers are start-ups.

IFR Secretariat

The General Secretariat is responsible for the daily management of IFR and the coordination of all major activities, events and collaboration. The General Secretariat handles all questions regarding IFR membership.

Dr. Susanne Bieller

IFR General Secretary

Phone: +49 69-6603-1502

E-Mail: secretariat(at)ifr.org

Silke Lampe

Communication Manager

Phone: +49 69-6603-1697

E-Mail: secretariat(at)ifr.org

Credits · Legal Disclaimer · Privacy Policy ·World Robotics Terms of Usage · © IFR 2026